Building Your Credit Score in America: The Real Talk Guide Nobody Gives You

Okay, so you made it to America - congrats! You've probably figured out the bank account thing (if not, go do that first), and now everyone keeps talking about this mystical thing called a "credit score." And you're sitting there like, "What the hell is a credit score and why does everyone act like it's more important than my actual money?"

Yeah, I had the exact same reaction. Coming from a country where having money in the bank meant you were financially responsible, the American credit system felt like some elaborate prank. But spoiler alert: it's very real, very important, and very confusing until someone explains it properly.

I'm going to save you from making the same mistakes I did (and trust me, I made ALL of them). This is the guide I wish someone had given me when I was standing in Target, confused about why they wouldn't give me a store credit card despite having $10,000 in my checking account.

Table Of Contents

- What's This Credit Score Thing, Really?

- The Brutal Truth: You're Not Starting at Zero, You're Invisible

- Your Credit Building Toolkit: What Actually Works (I've Tried It All)

- The Real Timeline: What Actually Happens (Not the BS Marketing Version)

- The Sacred Rules of Credit (Break These and You'll Hate Yourself)

- Mistakes That Will Make You Want to Scream (Learn from My Pain)

- Advanced Strategies (For When You're Ready)

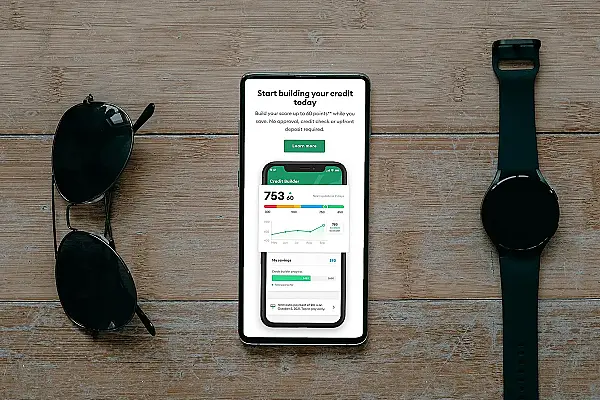

- Monitoring Your Progress: Tools and Apps

- The Long Game: Building Wealth Through Credit

- When Things Go Wrong: Damage Control

- You're Going to Be Fine (Seriously, I Promise)

What's This Credit Score Thing, Really?

Picture this: America has created a popularity contest, but instead of judging how cool you are, they're judging how good you are at borrowing money and paying it back. Your credit score is basically your report card for this weird financial popularity contest.

It's a number between 300-850, and here's the kicker - higher is better, but nobody really tells you what "good" means until you're getting rejected for stuff.

Here's why this number will control your life in ways that'll make you question everything:

- Apartment hunting: I watched my friend get rejected from 8 apartments in a row because his credit score was too low. He had three months' rent in cash, but nope - not good enough.

- Phone plans: Want that new iPhone? They'll check your credit before giving you a contract. I had to pay a $400 deposit for a basic phone plan because I had no credit history.

- Car shopping: My first car loan had a 18% interest rate. EIGHTEEN PERCENT. All because I had no credit. My American friend with good credit got 3%.

- Insurance: Yes, they even check your credit for car insurance. Because apparently, people with bad credit crash more? I don't know, the logic is questionable.

- Jobs: Some employers check credit, especially for finance jobs. Because nothing says "I'm good with money" like having borrowed money before, I guess.

The most maddening part? I had $15,000 sitting in my savings account and still couldn't get approved for a $500 credit card. The bank basically told me, "We don't care about your money - we want to see that you've borrowed someone else's money and paid it back."

Make it make sense, right?

The Brutal Truth: You're Not Starting at Zero, You're Invisible

Here's what nobody warned me about - in America, having no credit history isn't like starting at zero. It's worse. You're completely invisible to the credit system. The three big credit companies (Experian, Equifax, and TransUnion) have never heard of you. You literally don't exist in their system.

I found this out the hard way when I confidently walked into a bank to apply for a credit card. The banker pulled up my credit report and just stared at the screen with a confused look. "There's... nothing here," she said. "It's like you don't exist."

Gee, thanks. Really made me feel welcome.

What "invisible" actually means in your daily life:

- Online credit card applications automatically reject you

- Car dealerships laugh when you ask about financing

- Apartment applications go straight to the "nope" pile

- You're paying security deposits for EVERYTHING - electricity, gas, internet, phone

- Some employers might side-eye you during background checks

I remember my first apartment hunt. The landlord asked for my credit score, and I said, "I don't have one." He looked at me like I'd just said I don't have a Social Security number or something equally impossible. The security deposit went from one month's rent to three months' rent, just like that.

But here's the thing that kept me sane: literally everyone successful in America started exactly where you are right now. Your American friends, your coworkers, that person driving the nice car - they all had to build credit from nothing too. The only difference is they started when they were 18 and had their parents' help. You're just doing it as an adult, which is actually better because you won't make the stupid mistakes teenagers make.

Your Credit Building Toolkit: What Actually Works (I've Tried It All)

1. Secured Credit Cards: Your Golden Ticket

What it really is: You basically give the bank a security deposit, and they give you a credit card with that same limit. So if you deposit $500, you get a $500 credit limit. It's like having training wheels, but hey, at least you're riding the bike.

Why this doesn't feel like a scam: The bank reports your payment history to all the credit bureaus, which is exactly what you need. They're not risking anything because they have your money, so they're happy to approve you.

The cards that won't make you feel like a second-class citizen:

Discover it Secured: This was my first card, and I actually loved it. They give you cash back (yes, on a secured card!), and after about 8 months, they randomly upgraded me to an unsecured card and gave me my deposit back. Plus, their customer service doesn't make you feel like garbage for having a secured card.

Capital One Secured: Solid choice. No annual fee, and they're pretty good about graduating you to an unsecured card after you prove you're not a financial disaster.

Citi Secured: Takes a bit longer to convert to unsecured, but if you're already banking with Citi, they're more likely to work with you.

Critical warning: Make absolutely sure whatever card you get reports to all three credit bureaus. I had a friend who got a secured card that only reported to one bureau, and she wasted six months building credit that barely counted. Don't be like her.

2. The Authorized User Hack (AKA The Friend System)

How this magic works: Someone you trust with good credit adds you to their credit card as an authorized user. Boom - their entire payment history on that card suddenly appears on your credit report. It's like borrowing someone's good reputation.

Real story: My roommate added me as an authorized user on her credit card that she'd had for 4 years with perfect payment history. Within two months, my credit score jumped from "nonexistent" to 680. I didn't even use the card - just having my name associated with her good history was enough.

The catch (because there's always a catch): If your friend starts missing payments or maxes out the card, that shows up on your credit too. I've seen this backfire spectacularly when someone's ex-boyfriend added them as an authorized user and then went on a revenge spending spree after they broke up.

How to not ruin friendships:

- Pick someone who's financially responsible (not just your best friend)

- Offer to pay for any purchases you make

- Set clear boundaries about what you will and won't buy

- Maybe don't do this with anyone you're dating unless you're married

3. Credit Builder Loans (The Weird but Genius Option)

What this frankly bizarre product is: You "borrow" money that the bank immediately locks away in a savings account. You make monthly payments on this "loan," and when you're done, they give you the money back. It's completely artificial, but it works.

Why banks created this: They figured out that people like us needed a way to build credit, so they invented this weird workaround. You're essentially paying them to report good payment history on your behalf.

Where to find them: Credit unions are your best bet - they usually charge reasonable fees and actually want to help you succeed. Online companies like Self and Credit Strong specialize in these, but shop around because fees vary wildly.

Is it worth it?: If you can't get a secured card or authorized user status, yes. I had a friend who did a $1,000 credit builder loan for 12 months. Cost him about $50 in fees total, but his credit score went from nothing to 650.

4. Student Credit Cards (If You Qualify)

What it is: Credit cards designed for people with no credit history, usually students.

The catch: You need to be enrolled in school, and some want to see income.

Best options:

- Discover it Student: Same benefits as the regular Discover card

- Capital One Student Cards: Several options with different benefits

- Bank of America Student Cards: Good if you already bank with them

5. Store Credit Cards (Use with Caution)

What it is: Credit cards that only work at specific stores (Target, Amazon, etc.).

Why they're easier to get: Stores want your business, so they're more lenient with approvals.

The downside: Usually high interest rates and low limits. Plus, they scream "beginner" to future lenders.

If you go this route: Pay them off completely every month and use them as stepping stones to better cards.

The Real Timeline: What Actually Happens (Not the BS Marketing Version)

Let me give you the honest timeline based on what I've seen actually happen to real people:

Months 1-3: The Awkward Beginning

- You finally get approved for a secured credit card (after maybe getting rejected from a few others)

- You're paranoid about everything and probably check your account daily

- You buy like one coffee per month because you're terrified of messing up

- Nothing shows up on your credit report yet, which is frustrating

Months 3-6: You Officially Exist

- Your credit report finally gets created! You're no longer invisible!

- Your first credit score appears (probably around 600-650, which feels low but is actually decent for a beginner)

- You start feeling more confident and maybe use the card for gas and groceries

- You realize autopay is your best friend

Months 6-12: Things Get Interesting

- Your score starts climbing (hopefully hitting 650-700 if you haven't screwed anything up)

- You might get pre-approved offers in the mail (most are garbage, but still exciting)

- You apply for your first "real" credit card and maybe actually get approved

- Your secured card company might offer to convert to unsecured

Year 1-2: The Sweet Spot

- Score could hit 700+ if you've been good

- You can actually get approved for decent credit cards with rewards

- Car loans become possible at rates that don't make you cry

- Some landlords stop treating you like a financial pariah

Year 2+: Welcome to the Club

- You can get premium credit cards that make you feel fancy

- Mortgage pre-approval doesn't end in laughter

- You become the person your newer friends ask for credit advice

Reality check: This assumes you don't screw anything up. One late payment in your first year can set you back 3-6 months. I learned this the hard way when I forgot to pay my credit card while traveling and came home to a 40-point credit score drop. Took four months to recover.

The Sacred Rules of Credit (Break These and You'll Hate Yourself)

Rule #1: Pay Everything On Time, Every Damn Time

This is 35% of your credit score, and it's the difference between success and months of frustration. I cannot stress this enough - even ONE late payment in your first year can destroy your progress.

How I learned this the hard way: I was traveling for two weeks and forgot to pay my credit card. Just one payment, 5 days late. My credit score dropped 40 points and took four months to recover. FOUR MONTHS for one mistake.

Set yourself up to never fail:

- Autopay everything (seriously, just automate it)

- Set phone reminders a week before due dates

- Pay early if you're traveling

- Use calendar alerts like your life depends on it

Rule #2: Don't Max Out Your Cards (The 30% Rule Everyone Gets Wrong)

What everyone tells you: Keep your credit utilization under 30%. What actually matters: Keep it under 10% if you want a really good score.

Real example: My friend had a $500 credit limit and kept a $400 balance because "it's under the limit." His credit score sucked. When he started keeping it under $50, his score jumped 60 points in three months.

The trick: You can make multiple payments per month. I pay my credit card every week to keep the balance low, even though I only have one due date per month.

Rule #3: Never Close Your First Credit Card (Even If You Hate It)

Why this rule exists: Length of credit history is 15% of your score. Your first card is like the foundation of your credit house.

The temptation: Once you get better cards, you'll want to close that crappy secured card with no rewards.

Don't do it: Even if the annual fee annoys you, even if the card is ugly, even if you never use it. Just keep it open and use it once every few months for a small purchase.

Personal story: I almost closed my first secured card after getting a "real" card with rewards. My friend who worked at a bank literally grabbed my phone out of my hands to stop me from calling. "You'll regret this for years," she said. She was right.

Rule #4: Stop Applying for Every Card That Looks at You

The problem: Each application creates a "hard inquiry" that dings your score. The bigger problem: When you're new to credit, these hits matter more.

My mistake: I got excited when I started getting pre-approved offers and applied for three cards in one month. My score dropped 25 points, and I got rejected for the third card anyway.

Better strategy: Space applications at least 3-6 months apart. If you get rejected, wait 6 months before trying that same bank again.

Rule #5: Diversify Eventually, But Not Immediately

What this means: Having different types of credit (cards, car loans, etc.) helps your score in the long run.

The mistake: Trying to do everything at once when you're still learning.

Smart approach: Master credit cards first. Once you've got that down and your score is decent, then think about other types of credit.

Mistakes That Will Make You Want to Scream (Learn from My Pain)

The "I'll Pay It Off Next Month" Death Spiral

The logic that sounds reasonable: "If I carry a balance, it shows I'm using credit, which should help my score, right?"

Why this is completely wrong: Credit bureaus only care that you CAN borrow money and pay it back. They don't care if you pay interest. Carrying balances just costs you money and hurts your utilization ratio.

My expensive lesson: I carried a $300 balance on my $500 limit card for three months because I thought it would help my credit faster. Not only did it NOT help, but I paid about $60 in interest and my credit score was lower because of the high utilization. I was literally paying money to hurt my own credit score.

The "Gotta Catch 'Em All" Card Collector Syndrome

The mistake: Getting excited about being approved for credit and applying for every card possible.

Real story: My friend got his first approval and then applied for 6 more cards in two months. His credit score tanked, he got overwhelmed managing multiple payments, and he ended up missing a payment because he lost track of which card was due when. It took him over a year to recover.

What actually works: Start with one, maybe two cards max. Master those first. I know it's exciting to finally be approved for things, but slow down.

The "I Don't Need to Check My Credit" Ostrich Strategy

The dangerous assumption: Everything is probably fine, right?

Why this backfires: Credit report errors are shockingly common. I found out my credit report had me listed as living in three different states I'd never been to. If I hadn't checked, those errors would have stayed there indefinitely.

Free tools that actually work:

- Credit Karma: Updates weekly, shows you TransUnion and Equifax scores

- Experian app: Free FICO score (this is what most lenders actually use)

- AnnualCreditReport.com: Official site for your full reports

Check monthly: Set a reminder on your phone. It takes 5 minutes and can save you months of headaches.

The "Minimum Payment Is Enough" Trap

Why people think this: Minimum payments don't hurt your credit score, so they must be fine, right?

The hidden problem: You're paying interest for no reason and reducing your available credit. Plus, if you only pay minimums, you're always close to your credit limit, which hurts your utilization ratio.

Better approach: Pay off the full balance every month if you can. If you can't, pay as much as possible above the minimum.

The "Store Card Shopping Spree" Disaster

How this happens: Store cards are easy to get approved for, so you get one at Target, then Best Buy, then Amazon, then everywhere else because why not?

Why it's a nightmare: Multiple hard inquiries hurt your score, store cards usually have terrible interest rates, and managing 5+ credit cards when you're still learning is asking for trouble.

The smarter way: Maybe one store card if you shop there religiously, and only after you've mastered your first regular credit card.

Advanced Strategies (For When You're Ready)

The Product Change Strategy

Once you've had a secured card for 6-12 months with good payment history, call and ask if they can convert it to an unsecured card. Many banks will do this and refund your deposit.

The Credit Limit Increase Request

Every 6 months, call your credit card companies and ask for limit increases. Higher limits lower your utilization ratio automatically.

The Balance Transfer Consideration

If you end up with balances on high-interest cards, look into 0% balance transfer offers once your credit improves. But be careful - these often have fees and time limits.

The Authorized User Network

If you have multiple friends or family members with excellent credit, becoming an authorized user on several accounts can boost your score faster. Just make sure they all have perfect payment histories.

Monitoring Your Progress: Tools and Apps

Free Credit Monitoring

- Credit Karma: Free scores from TransUnion and Equifax, updated weekly

- Experian app: Free FICO score and credit report from Experian

- Credit.com: Free monthly updates and credit advice

Official Credit Reports

- AnnualCreditReport.com: Free annual reports from all three bureaus

- Check all three: Lenders report to different bureaus, so check them all

What to Look For

- Payment history (any late payments?)

- Account balances and limits

- Length of credit history

- Types of credit accounts

- Recent credit inquiries

- Any errors or accounts you don't recognize

The Long Game: Building Wealth Through Credit

Once you've got the basics down, good credit becomes a wealth-building tool:

Real Estate: Good credit can save you hundreds of thousands on a mortgage Business Loans: Starting a business often requires good personal credit Investment Opportunities: Some investment accounts require credit checks Emergency Access: Credit lines can be lifelines during tough times

But remember: Credit is a tool, not free money. The goal is to have access to it when you need it, not to live beyond your means.

When Things Go Wrong: Damage Control

If You Miss a Payment

- Pay it immediately

- Call the credit card company and ask them to waive the late fee (they often will for first-time offenses)

- Don't panic - one late payment won't destroy everything, but don't make it a habit

If You Get Denied for Credit

- Ask for the specific reasons (they're required to tell you)

- Wait at least 6 months before applying again

- Work on the specific issues they mentioned

- Consider a secured card if you were going for unsecured

If You Find Errors on Your Credit Report

- Dispute them immediately with the credit bureau

- Provide documentation supporting your claim

- Follow up if they don't respond within 30 days

- Consider hiring a credit repair company for complex issues

You're Going to Be Fine (Seriously, I Promise)

Look, I'm not going to lie to you - building credit in America is frustrating as hell. The system is weird, the rules seem arbitrary, and you'll probably get rejected for things that don't make sense. I once got turned down for a store credit card at RadioShack (RIP) despite having perfect payment history on my secured card. RadioShack! For a $200 credit line!

But here's what I need you to understand: every single successful person in America has been exactly where you are right now. That colleague who just bought a house? Started with no credit. Your friend with the amazing rewards credit cards? Began with a secured card just like you will. Your professor who seems to have it all figured out? They once stood in a bank feeling confused about credit scores too.

The part that nobody tells you: This isn't just about building a credit score. You're learning how to navigate American financial culture. You're developing habits that will serve you for decades. You're proving to yourself that you can master yet another complicated American system.

Start today, even if it feels small. Apply for that secured credit card this week. Ask that responsible friend about being an authorized user. Set up autopay so you never miss a payment. Every day you wait is a day you could have been building credit.

Give yourself some grace. You're going to make mistakes - we all do. I missed payments, applied for too many cards, and made pretty much every error in this guide at least once. The difference between people who succeed and people who don't isn't perfection - it's getting back up and trying again.

Two years from now, you'll be getting pre-approved offers for premium credit cards. You'll be the one explaining credit to confused newcomers. You'll look back on this time and remember how overwhelming it felt, but also how proud you were when you got that first approval.

The American financial system is just another challenge to conquer, and honestly? If you've made it to America and navigated everything else you've dealt with, you can definitely figure out credit scores.

You've got this. Now stop overthinking it and go apply for that secured card. Your future self is going to thank you.

Add Comment

No comments yet. Be the first to comment!